Import Export Code - IEC

IEC (Import Export Code) is required by everyone who is willing to start import/export business in the India. It is issued by the DGFT (Director General of Foreign Trade). IEC is a 10-digit code (Now a days PAN no. itself IEC) which has a lifetime validity. But having PAN itself does not mean that IEC need not to be applied, when IEC is applied than DGFT issued a certificate then only eligible for import / export though IEC is PAN itself.

IEC is required in the following situations

- To clear shipment from customs in case of imports

- To send shipment in case of export

- For sending money outside India by an importer

- To receive money by exporter

Steps Involved in IEC (Import/Export Code) Registration through DGFT

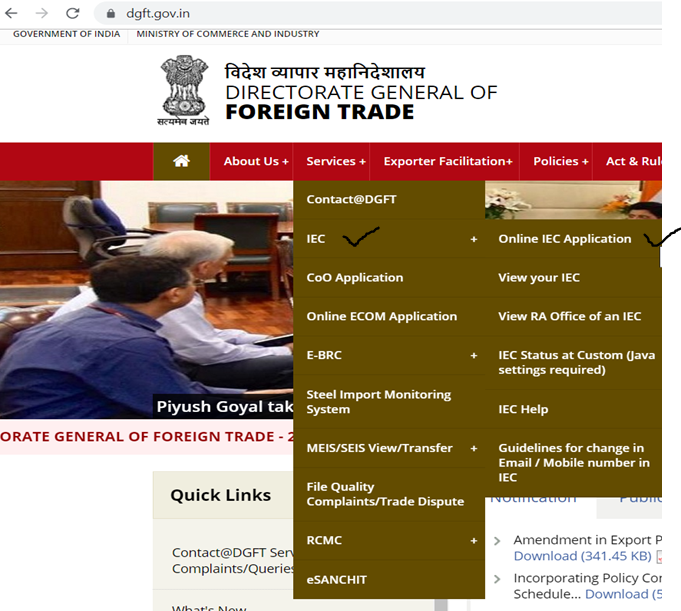

Step 1: visit DGFT site www.dgft.gov.in and click on Services tab and then click on Online IEC Application in IEC tab as shown in below pic

Step 2: after that below shown window shall be displayed on DGFT site

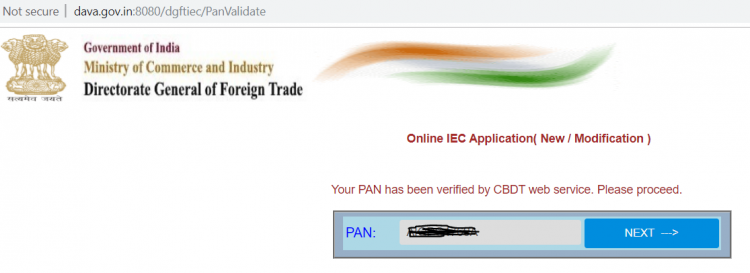

Enter PAN no. of business in above and click on Search tab (In case of Proprietorship firm PAN of Proprietor and in case of Partnership firm PAN of Firm and in case of Company PAN of Company)

Then below window shall open. In this window enter Name of Pan Holder and Date of Birth in case of Individual and Date of Registration / Formation / Incorporation in other like Partnership Firm/ Company etc.

Now Click on Submit tab, then below window shall open if your PAN is valid and verified by CBDT as shown below.

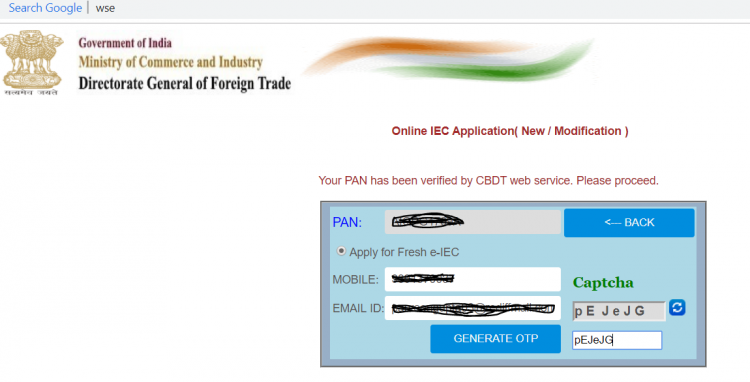

Now Click on Next tab…. below shown window shall be displayed at DGFT site

Enter Mobile No., Mail ID and Captcha code and click on Generate OTP tab and enter both Mobile and Mail OTP and enter Captcha code again and click on Submit tab…. Below shown window shall be displayed

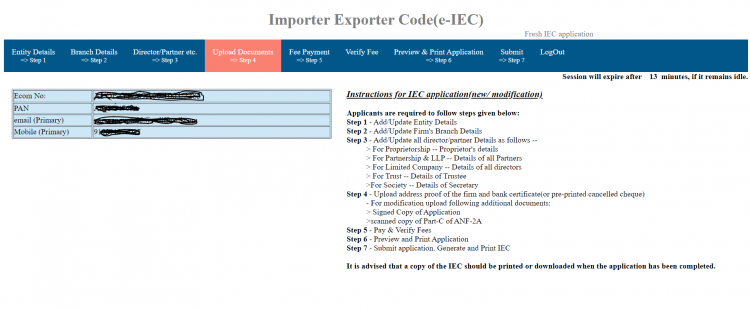

Step 3

Now Click on first tab i.e. Entity Details fill all the details like Name, Address, Entity type, Bank details etc.

Then Click on second tab i.e. Branch Details and enter details of Branches of business, if any otherwise leave it blank.

Then click on third tab Directors / Partners etc. and enter details of Partners, Proprietor or Directors.

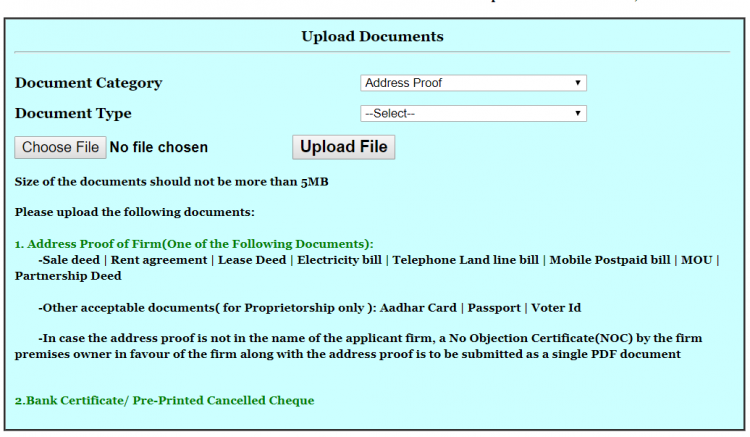

Then click on fourth tab Upload Documents. Below window shall open for upload of documents:

As mentioned in above pic following Documents required:

- Address Proof : Sale Deed / Rent Agreement / Lease Deed / Electricity Bill / Landline Telephone Bill / MOU / Partnership Deed

- Bank Certificate / Pre-Printed cheque (with business name as mentioned on PAN)

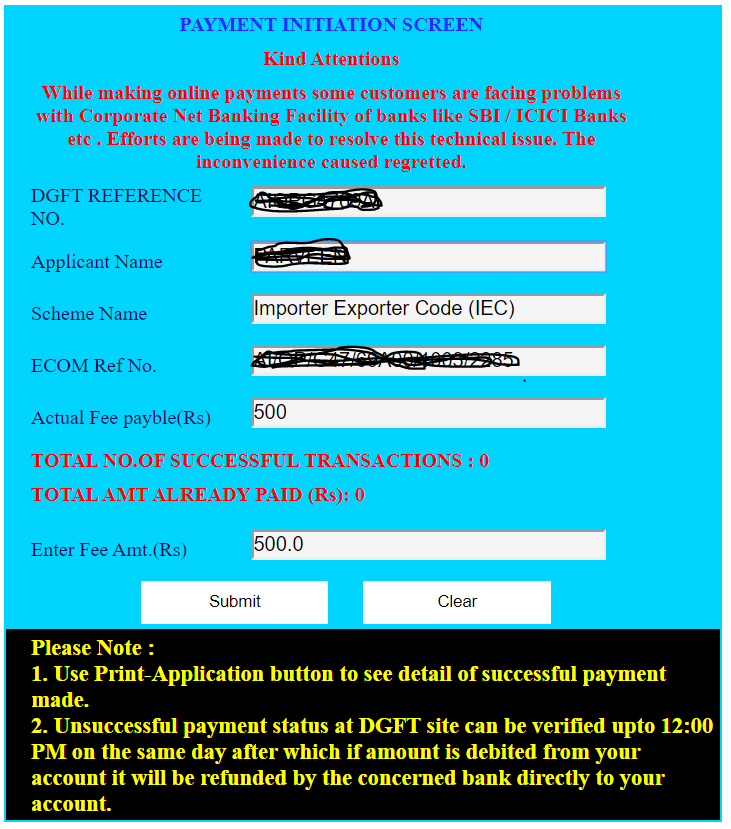

After Uploading documents now move for 5th tab i.e. Fee Payment …. Below window shall be displayed for making payment

Now clik on submit tab and Pay fees of Rs. 500/- and move to sixth tab Verify Fees.

Now move to seventh tab Preview and Print Application….. When you will click on this tab…. Fully filled Form ANF-2A shall be displayed for review. Now check all the details filled by you and fill self-declaration at the end of this form.

Step 4

After this if you find all the details in order then move to last step i.e. Submit Form

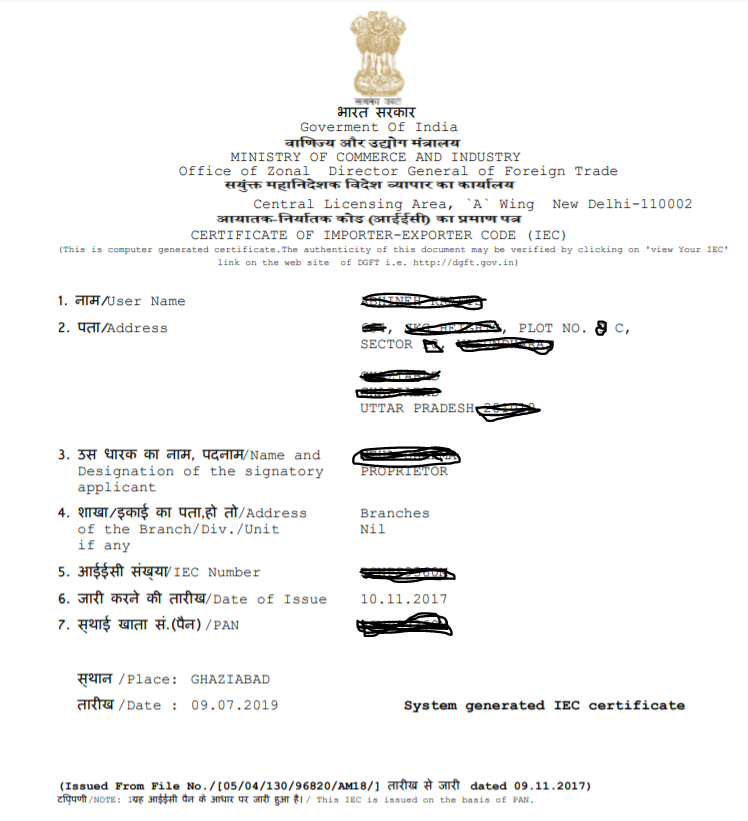

And soon as you will submit the form you will get the IEC code certificate from DGFT on your mail as shown below.

So No any need to visit any department, No any need of any DSC, No any need of any affidavit / Photo/ Declaration etc.

Its Digital India ! Incredible India!

Download APP

Download APP

P K Gupta

P K Gupta